Posted 19th July 2021

The following blog was written by Charlotte Österman, Private Sector Lead, Social Value UK.

Risk. The impacts and value that our movement sets out to measure, has also got an inherent link to the risk associated with aspirations not being met or the negative consequences not being managed and minimised. Risk has a clear link to our mission of reducing environmental degradation and inequality + create more wellbeing for all. But perhaps we don’t talk enough about risk? Let’s dive into two projects that have discussed risk in relation to the social value and share some insights.

Impact Management Project

The Environment, Social & Governance (ESG) criteria that has been used by investors to better understand sustainability performance of an asset/investment; is heavily linked to understanding the (especially financial) risk of an investment for example not delivering the yield expected. To expand that, Social Value International (SVI) has also long been banging the drum around risks to stakeholders and environment. So perhaps it is not surprising that the biggest global initiative to define impact, which has been convening over 2,000 practitioners from all across sectors, but in particular intelligence from the financial sector, has given risk a prominent role.

This initiative is the Impact Management Project (IMP) – a forum for building global consensus on measuring, managing and reporting impacts on sustainability. If you are not aware of it, check it out: https://impactmanagementproject.com/

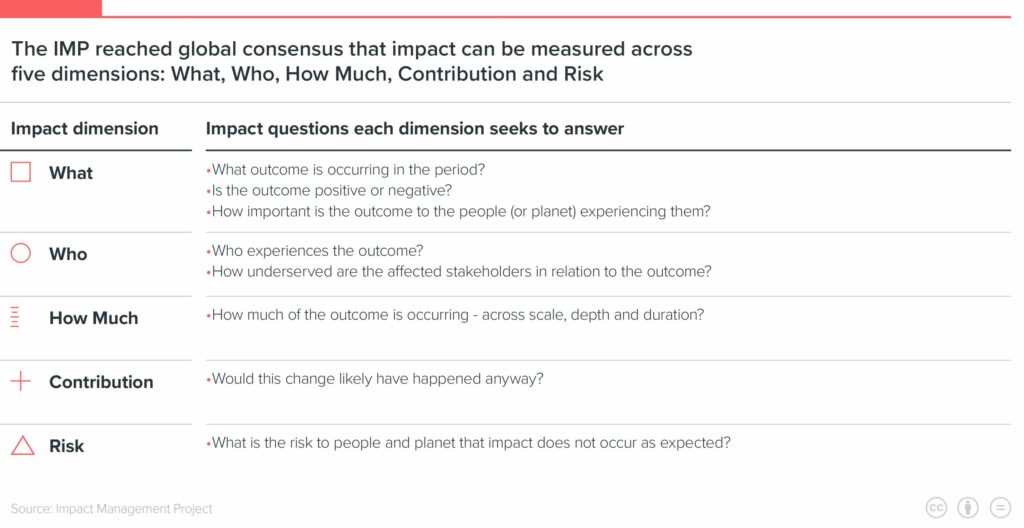

The IMP has created a common definition that acknowledge the importance of companies and investment reporting on both positive and negative impact (we like it! See e.g. Guidance on Principle 2 recognised the same thing) as a way to manage better ESG risks and contributions to the Sustainable Development Goals (SDGs). To do so, the IMP introduced 5 dimensions (What, Who, How, Much, Risk) to assess the impact from. Let’s dive into the impact risk one for which Social Value International developed the approach to.

First, note that there 9 types of impact risks to look at: Evidence risk, external risk, stakeholder participation risk, drop-off risk, efficiency risk, execution risk, alignment risk, endurance risk and unexpected impact risk.

What you then need to do is to assess each one of these through considering the likelihood and consequences of not achieving a specified social or environmental outcome (risk assessment).

With that information at hand you then work to mitigate the impact risk through adjusting the organisation’s (business) model based on that risk assessment.

A conclusion, we always assess risk when investing for financial returns. So why wouldn’t we assess risk when investing for social and environmental returns?

In a world where ‘investors’ increasingly want their investments to be ‘ethical, ‘responsible’ or ‘sustainable’ then it is essential that all investment is assessed for impact risk. There are different lenses for risk. Most ESG reporting is exploring the risk that profitability of a business is at risk from sustainability issues. Social Value International and Social Value UK believe that the risk management should focus on the risk posed to the people who experience the ‘sustainability issues’ or ‘impacts’. This risk lens should be checking from the stakeholders’ perspective – is the impact harmful or not good enough?

SVI are introducing a new principle called Be Responsive which is all about making decisions and using the impact data and we expect this to cover risk management. Expect more in this space! If you are a risk expert interested in social value, impact sustainability – please get in touch.

Value Toolkit (UK Built Environment)

In another sector and new development, risk has also been given recent attention. The Value Toolkit is a new process, tools and guidance to support value-based decisions at every point through the life of an asset. The integrated streams of activity include:

- Value Definition, which helps clients consistently articulate what value means to them for a specific investment (SVUK acted as Relevant Authority for the Social Capital)

- Client Approach which builds on the clear articulation of value, to select the most appropriate commercial strategy and delivery models to realise value through delivery and into operation

- Risk, which encourages the active management of risk throughout the delivery phases to underpin better outcomes

- Measurement and Evaluation helps to compare options and ensure there is an appropriate strategy to capture outcomes

- Appointments will help to ensure you have the right team in the right place to deliver better outcomes.

So, a little more on risk, the primary purpose of this stream is to help clients identify the risks associated with specific outcomes identified through the Value Definition stage by creating a Risk Profile. We can achieve better outcomes by identifying the risks and more comprehensively controlling them through delivery, which sounds simple enough, but isn’t always the case.

A successful risk management approach is a continuous process that has a vital role throughout the entire lifecycle of a project or programme, which is why the Value Toolkit is a series of integrated activities. It is an iterative process with crucial steps to undertake at every phase, from identifying the risk and understanding the risk potential, to risk assessing, dealing with the risks identified and monitoring risk with complete transparency.

Quick takeaways from the Value Toolkit approach to risk:

Take a holistic approach to risk. By using the four capitals approach, clients will have a broader landscape to scope and identify potential threats to the outcomes they wish to realise.

Engage the market early to gain a better understanding of the scale of risks that the market perceives.

And don’t forget the importance of the Project Board involvement to ensure full transparency and the right mindset, i.e. don’t forget about opportunities, when assessing risks.

But most key, is to build the risk assessment into your process, so you can actively manage it at every stage.

- A user would also assess and manage risks associated with the measurement itself, performance requirements and much more. But for more on this and the details we will have to wait until the Value Toolkit officially launches at the end of this year. Stay tuned!

The future of risk…

The above present how risk management is rising not only in prominence of conversations but is being increasingly important in conjunction with other areas. We have been experiencing a ‘reset’ of our values and priorities in recent times, consumers and society value positive contributions to people and planet, this is just one way to highlight the shift from a social value focus based towards positive contributions rather than mitigating and understanding the evident risks associated.

We’re living in uncertain times, and we fully expect to see more advancements of risk concepts in social value accounting and in our networks, but we will be working to share and collaborate to bolster our mission of improving wellbeing and equality and reducing environmental degradation.